Federated Funding Partners Reviews Things To Know Before You Buy

Table of ContentsFacts About Federated Funding Partners UncoveredFederated Funding Partners Bbb Can Be Fun For AnyoneGetting The Federated Funding Partners Bbb To WorkFederated Funding Partners Reviews Can Be Fun For EveryoneFederated Funding Partners Bbb - The FactsFederated Funding Partners Legit - The Facts

84 in interest. 04 over the life of the car loan. Even if the regular monthly payment remains the same, you can still come out in advance by simplifying your car loans.91 * 3) $1,820. 74 * 3) $20,441. 22 Nonetheless, if you transfer the equilibriums of those 3 cards right into one consolidated lending at an extra practical 12% interest price and you proceed to pay off the lending with the very same $750 a month, you'll pay about one-third of the passion$ 1,820.

This totals up to an overall cost savings of $7,371. 51$ 3,750 for repayments as well as $3,621. 51 in passion.

Federated Funding Partners Reviews for Dummies

Have you maxed out your credit scores card? Balancing all of your financial debts can be a test of your multitasking skills, and your peace of mind., you can make your life much easier and start living debt-free.

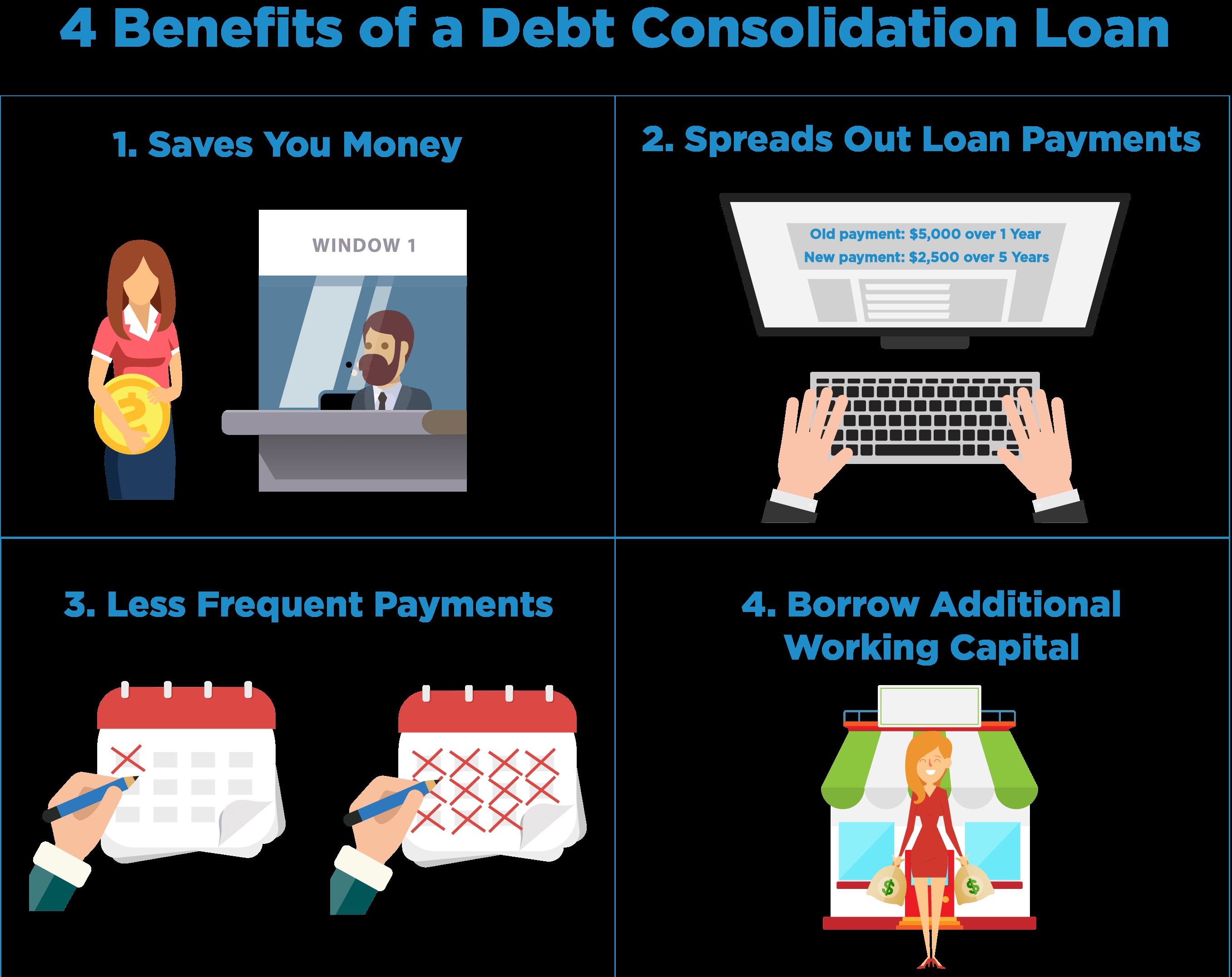

The advantages of debt combination don't end there: Debt debt consolidation fundings are billed at a much lower rate than all of your private finances or financial obligations, such as hire acquisitions or bank card. The ordinary New Zealander is currently burdened with record levels of financial debt. Possibilities are, you are just one of them.

Some of your finances might be due by the end of the month. A financial obligation loan consolidation financing makes life very easy, giving you simply the one month-to-month payment as well as a repayment term that is typically a lot longer than your existing debts.

The Of Federated Funding Partners Reviews

They each come with their very own terms, conditions, prices as well as repayment days. Managing everyday life is challenging enough without the included tension of multiple financial institutions breathing down your neck, which is why consolidating your financial debts right into the one loan is simply so practical.

Life's a marathon, not a sprint. Yet you're probably running a million miles an hour just to maintain. It's simple to neglect a repayment when you're so busy. The resulting late fees, charges, in addition to possible resilient marks versus your credit score record are an unneeded hassle. With just the one funding? There's absolutely nothing to neglect.

Your financings and also financial obligations are all taped in your credit history report, which is where your credit report comes from. Settling your financial debts with a financial debt loan consolidation funding will note these as paid on your credit report, which will certainly enhance your credit history by showing that you're an accountable debtor who can satisfy their monthly payments.

The Buzz on Federated Funding Partners Reviews

Emergency situation expenses as well as extensive bank card use can land you in a sticky economic scenario where you're left paying high-interest rates on all kinds of debt. In this instance, financial obligation combination can be a feasible choice to aid try the debt as well as possibly pay it off sooner. Here are just a few benefits of the financial debt consolidation procedure.

Repay High Passion Credit Score Card Balances Many credit rating cards utilize revolving debt. This suggests you can utilize as much or as little of limit amount set by the credit scores card firm. While it's excellent to have that adaptability when you require accessibility to credit, lots of find it tough not to spend beyond your means and fall under huge bank card debt.

This kind of car loan is thought about an installation funding. By moving your debt card financial debt to an individual funding, you'll be able to pay it off rapidly as well as save in life time interest.

What Does Federated Funding Partners Bbb Mean?

* Annual Portion Rate. Prices vary, are subject to change, and also are based upon specific credit value. Price estimated is based on A+ debt rating. Repayment instance: A debt combination finance of $10,000 for 60 months at 5. federated funding partners legit. 75% APR website here will certainly have a month-to-month settlement of Discover More $192. 17. Not all candidates will qualify.

The 15-Second Trick For Federated Funding Partners

With a debt combination loan, the general rate of interest you will pay will typically be decreased versus what you would certainly pay on charge card. While you should check the rate of interest useful link rate of a debt loan consolidation financing before making an application for one, it may be an option that can result in cash financial savings. This is absolutely real if you deal with a situation similar to the one above, where you're monetarily 'walking water' and also doing no greater than settling the rate of interest every month.

While you must inspect the rates of interest of a financial obligation consolidation lending prior to obtaining one, it may be an option that can cause cash cost savings." 4. Aid with Your Credit Rating The most convenient way to consider this is to envision you continuing with your current economic situation against securing a debt loan consolidation finance.